If you are an expatriate, or just visiting a country abroad, living abroad insurance can protect your financial security and provide peace ofmind. It is an excellent option for long-term travelers and families who need to cover all family members.

It's not easy to select an international health insurance plan. You should be aware of the specifics before you make your purchase. Getting a policy from a reputable company can help to ensure that you have peace of mind while traveling abroad.

Expat/Expatriate - An Overview

For many, living abroad can be an exciting and challenging experience. You might have to learn to speak a new tongue or adapt to another culture. You may also need information on how to access the public healthcare or pay private fees in a clinic.

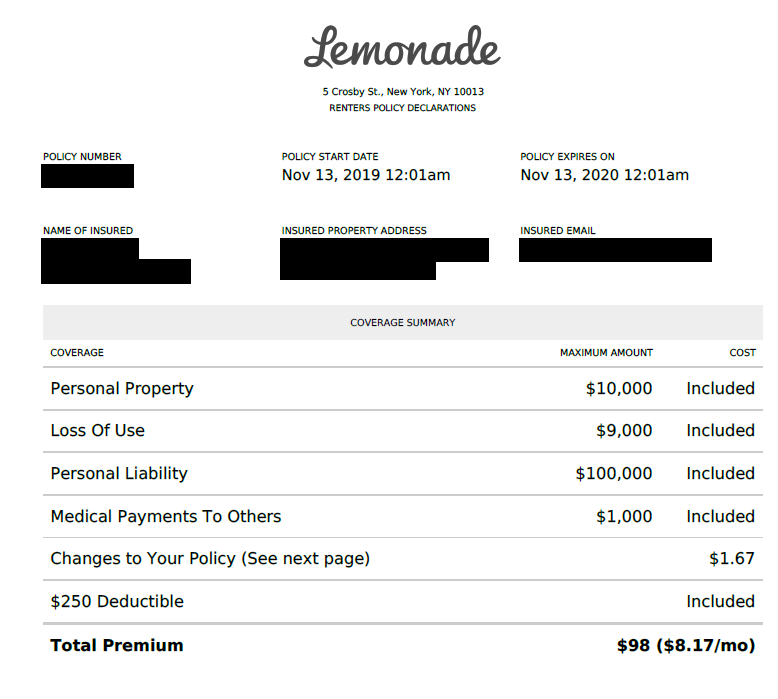

In order to ensure that you are covered for any medical emergencies abroad or at home, it is best to purchase an international insurance policy. These policies are typically available in various formats and can even be customized to fit your specific needs.

How to Purchase an Expatriate Insurance Plan

Expat health plans typically offer more benefits than travel insurance, including accident, critical illness and dental and vision coverage. Some international health insurance plans include emergency care and evacuation in their benefit package.

US Citizen Health Insurance Overseas

You may qualify for Obamacare compliant medical insurance if you are a US citizen traveling outside of the U.S. You can however take advantage of exemptions.

The IRS's "Physical Presence Test" allows US citizens who are physically present in another country for at least 330 days each year to qualify. Another exemption for US citizens is the Bona Fide Residence Test.

You should look into international medical insurance as soon as you can, if your are a US national who lives and works in another country. You'll avoid having problems with the visa office, as well as paying out of pocket for expensive medical bills.

You should contact an expert who specializes in international medical insurance. An expert in international health insurance can help you find the right plan for your specific needs.

Comparing expat medical policies is important because you need to consider factors such as your age, current health, and other things that could affect the cost. This will allow you to select the right policy for yourself and your family.

How to buy a health insurance plan for expatriates

Online, over the telephone and in person are all ways you can purchase international medical insurance. You can get quotes from local insurance companies or speak to an international health insurance expert.