The protection of your home is important. It's not always possible to anticipate the risks that come with owning a property, but having a policy in place can help mitigate losses in case of theft, fires, or other unexpected events.

The right insurance company is crucial to getting the best coverage for the lowest cost. Our comparison of the top Utah home insurance companies is based on the rates, policies and customer satisfaction scores to help you choose the right insurer for your situation.

Utah homeowners insurance costs $784 per year, which is much lower than the average national cost of $1,899 per year. The cost of homeowners insurance in Utah is determined by a number of factors, such as the age and location of your house.

MoneyGeek’s Utah insurance calculator allows you to estimate your costs using thousands of quotes received from leading insurers.

Farmers - The cheapest option for baseline dwelling coverage in Utah With an average annual rate of $432, Farmers is the cheapest Utah homeowners insurance for people who want to buy a new home, pool owners, those with poor credit and those looking for baseline dwelling coverage under $250,000, according to our analysis of more than 20,000 homeowners insurance quotes in partnership with Quadrant Information Services.

USAA – Another company worth considering is USAA. It has a Bankrate score of 4.8, and it is one of only a few Utah home insurance companies that sells policies to former servicemen. The company also offers a variety of optional features, such as replacement cost coverage and identity theft protection.

Earthquake coverage - Because many home insurers do not include coverage for earthquakes in their policies, it's a good idea to consider this coverage. You should still add earthquake coverage to your Utah homeowners policy even if you are not near fault lines.

We are the top-rated home insurer in Utah. With our On Your Side review, a service we offer for free that ensures your policy is covering all the items that are important to you and the family. You'll be able to review your policy, make any changes, and get a quote for any upgrades you need to make, all while getting the peace of mind that comes with knowing that you're covered.

You can view your insurance policy, including all coverages, in our online portal. You can also contact a Nationwide representative for assistance if you need more information or have questions.

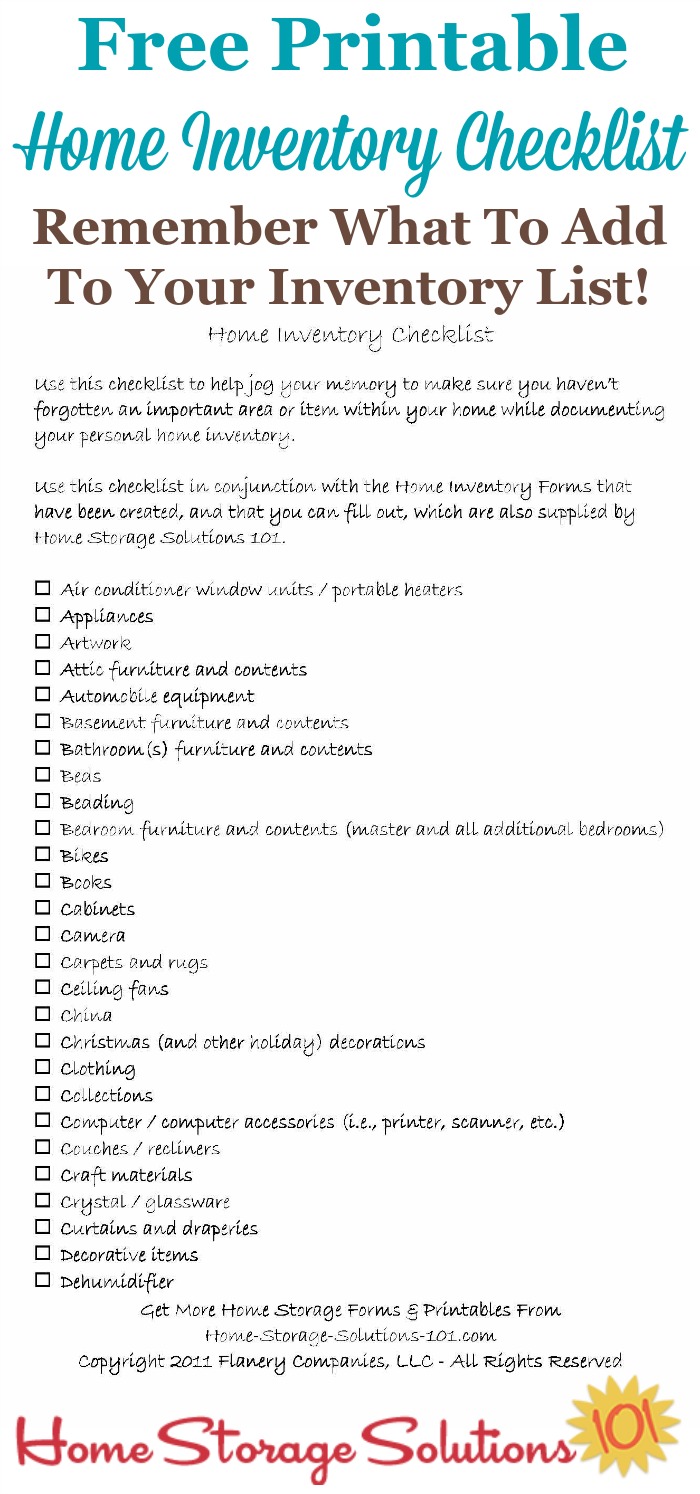

According to your needs, there are several types of Utah home insurance that you will need to protect and cover your property. Coverage can include personal belongings, liability and payments for medical expenses to others.

You can adjust your deductible by speaking with an agent or adjusting your policy online. Your deductible can be adjusted by speaking with a representative or changing your policy online.