A new home insurance policy is a good option for homeowners renovating their existing home or building one. This is a good way to save money on your new home, and it can protect you against unexpected damage or loss.

When it comes to insuring new construction, there are several different policies to consider. It covers damage to both the building as well as the belongings in the property. Another is "building home insurance." The "building home insurance" covers both the on-site and the off-site damage to the building materials. You may also be covered for any additional structures that are on your property, such a fencing or outbuildings.

Once you find a suitable location, start searching for home insurance. This will let you find the best insurer and save money.

The policy will cover all losses, including those to your personal property such as furniture, appliances, clothes, and electronics. In addition, the policy provides liability protection that covers medical expenses for anyone injured on your premises.

Insurance for new constructions is determined by the type of building you are building and your budget. Some companies offer discounts if you install certain devices and systems in your new home that help to prevent fires or break-ins. Use of roofs that are made with stronger and durable materials may also result in discounts.

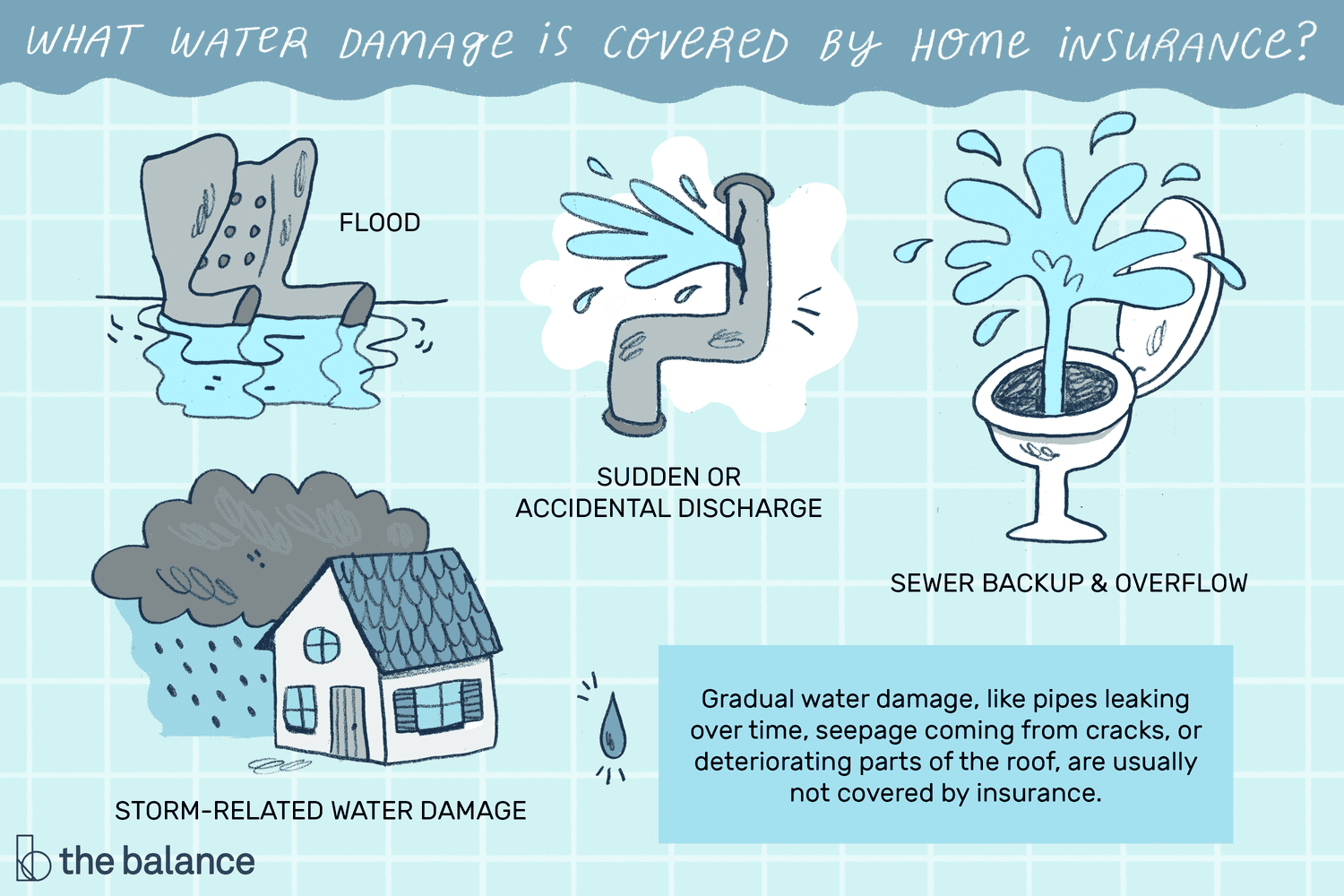

You can purchase a separate insurance policy to cover weather-related damages or any other damage that may occur during construction. This coverage is sometimes referred to as "builders risk insurance." It's best to buy it before construction starts and then convert it into a standard homeowners policy after the project is complete.

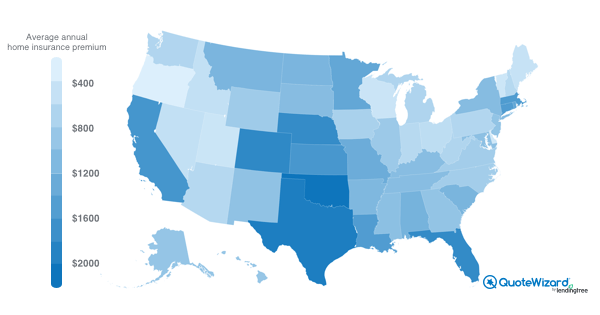

Insuring newly built homes is usually less expensive than insuring older ones because of the lower likelihood that they will suffer significant damage. This is because new homes have been built with new materials that are less prone to breakdown or need repair, so the insurance company is comfortable offering coverage at a lower rate.

A homeowners insurance policy will not cover contents, liability, or loss of use for a newly constructed home. However, some policies do have an add-on that will allow you to insure all your personal belongings and other items within the home under the same policy.

Home insurance may include extras such as a system to detect water leaks and shut down the water supply. Water damage can be costly to repair and is one of the main causes of home damage.