A homeowner's policy is essential to protect your home and belongings from theft or damage. You can also get help with additional living costs if you need to move because of a natural disaster or other covered loss. It's therefore important to choose a policy that suits your specific needs.

Best Home Insurance Companies Oregon

It is important to choose an insurance provider who offers you the coverages that you need, at a cost you can afford. MoneyGeek assessed the top Oregon home insurance providers based on their affordability, claim experience, customer service and financial stability.

American Family took the top spot for the overall rating, but Country Financial and Farmers received high marks as well for their affordability and service quality. Whether you're in the market for a new policy or want to switch, these companies offer a variety of coverages and discounts to meet your needs.

Country Financial, as an example, offers a very rare option of earthquake coverage, which can protect your property and home against natural disasters. This coverage may or may not apply to all areas.

Compare quotes from different insurance companies to find the best policy for you. Work with your agent to make sure that you get enough coverage. You can increase the coverage limits of your Oregon home insurance policy if you need to.

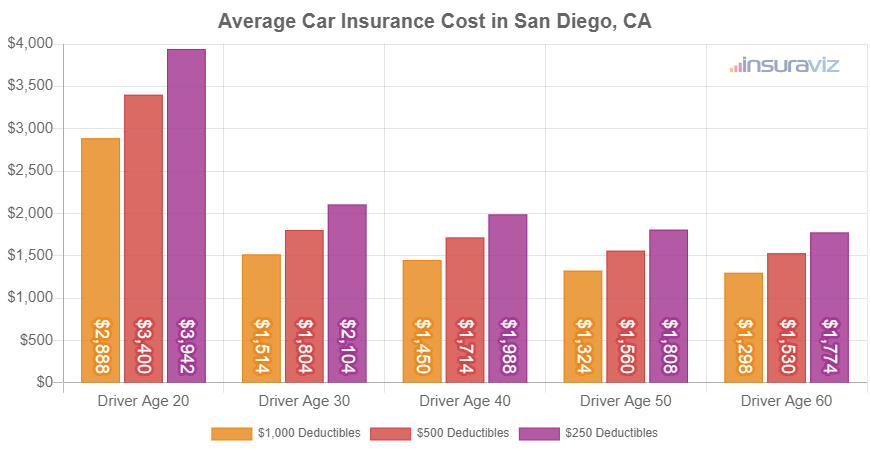

What is the Best Deductible?

The amount you have to pay for a homeowners claim will be affected by the deductible. Setting a budget-friendly deductible is the best option.

If you reside in a house that insurers consider high-risk, your insurance policy could include a higher standard deductible. You can often get a lower deductible if you are able to take advantage of incentives or discounts.

Take advantage of discounts to save money on your homeowners insurance. These discounts could be as little as 5% off your premiums, but over time they can save you hundreds.

Credit checks can make or break your rate

Good credit is important in the highly competitive homeowners insurance industry. A good credit rating can help you qualify to receive a lower rate on your homeowners insurance policy because lenders view you as a customer who is reliable and will pay their bills on time.

The majority of Oregon homeowners insurance companies run a full credit check prior to approving any policy. This is because they want to know that you can handle the risk of a claim should one occur.

How to Find the Lowest Homeowners Insurance Rates in Oregon

Oregon homeowners insurance rates are lower than national averages, so you can easily find a policy within your budget. Check with your local agent for more information on how you can reduce your premium.