You and your car are covered by car insurance ky if you're involved in an incident. Kentucky law requires that drivers carry liability insurance to legally operate their vehicle. However, you can choose to add additional coverages like uninsured driver coverage or rental reimbursement.

Your auto insurance ky cost will depend on your driving history, age and how much insurance you require. This is especially true for young drivers who are still learning how to drive. Compare prices and options when you are looking for new auto insurance.

In Kentucky, drivers with a good driving record will usually receive the lowest rates. These drivers are known for their clean driving records, meaning they have made fewer claims and are viewed as less risky by insurance companies.

Insurance companies may offer discounts for a variety of reasons, including a good driving record, a low mileage, and multiple vehicles being insured by the same company. These discounts can save you a lot on your annual insurance policy.

Kentucky is crackingdown on uninsured driving, which makes it more critical than ever for drivers to have adequate coverage. It is also required by state law that you have PIP (personal injuries protection) coverage unless your opt-out from the state's insurance program. Your insurance company can offer you this coverage, which covers injuries and property damage caused by other drivers or their passengers.

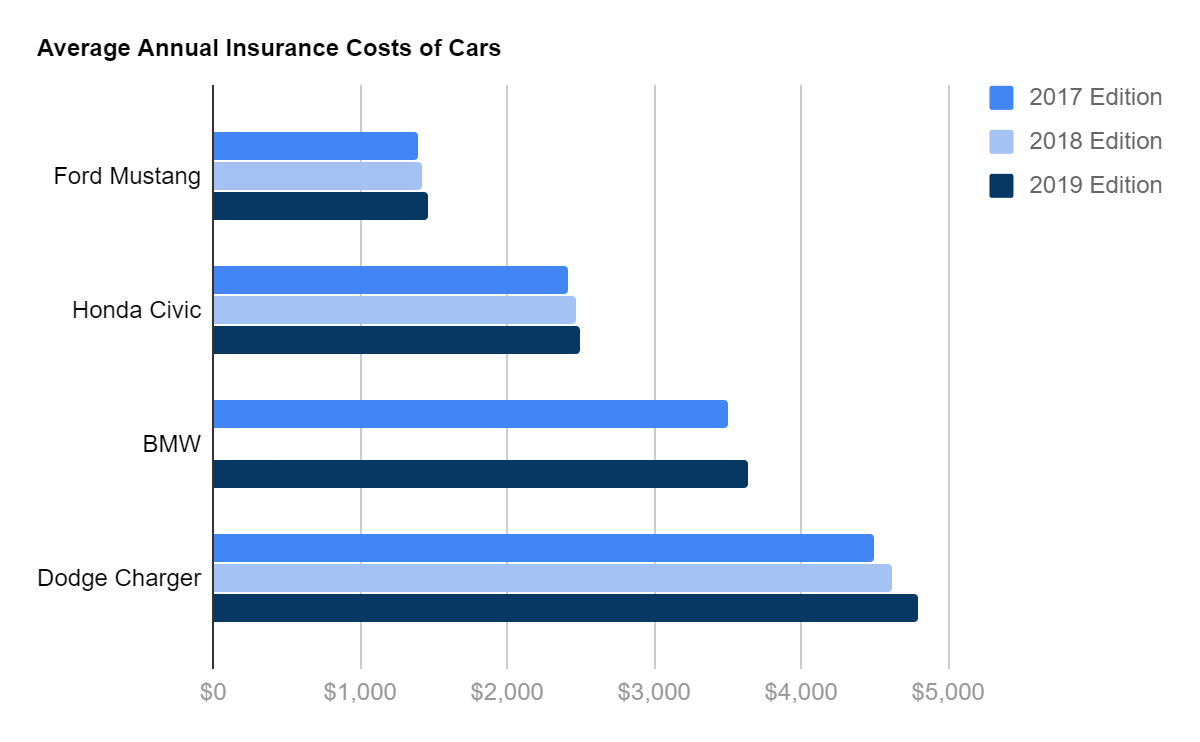

Depending on the type of coverage you choose, you can expect to pay anywhere from $1,486 per year for minimum liability insurance to $2,017 per year for comprehensive coverage in Kentucky. It can vary greatly by zip code. So, it is important to do your research and make an educated decision.

If your car is older, you may be able to reduce the cost of insurance by selecting a usage-based policy or opting for a lower coverage limit and higher deductible. Consider this option if your family includes a teenager who will need to be covered under your policy.

Credit score is another important factor in determining how much car insurance you will have to pay in Kentucky. Bad credit is associated with higher insurance premiums. This is especially the case if one lives in a region with high accident rates, such a city.

By choosing an affordable deductible and opting for collision or comprehensive coverage, you will also be able to save on your Kentucky auto policy. These coverage types can protect you better in the event of a car accident and are especially useful when shopping for insurance.

Kentucky has among the highest fatality rates for car accidents, so it is important to have the right auto insurance. It is important to review your existing policy periodically and see if it needs any adjustments.