Houston has a high accident rate and it is important to protect your finances by having auto insurance. It will protect your car from damage and theft. The right insurance can help you avoid paying a fortune in repairs for your vehicle.

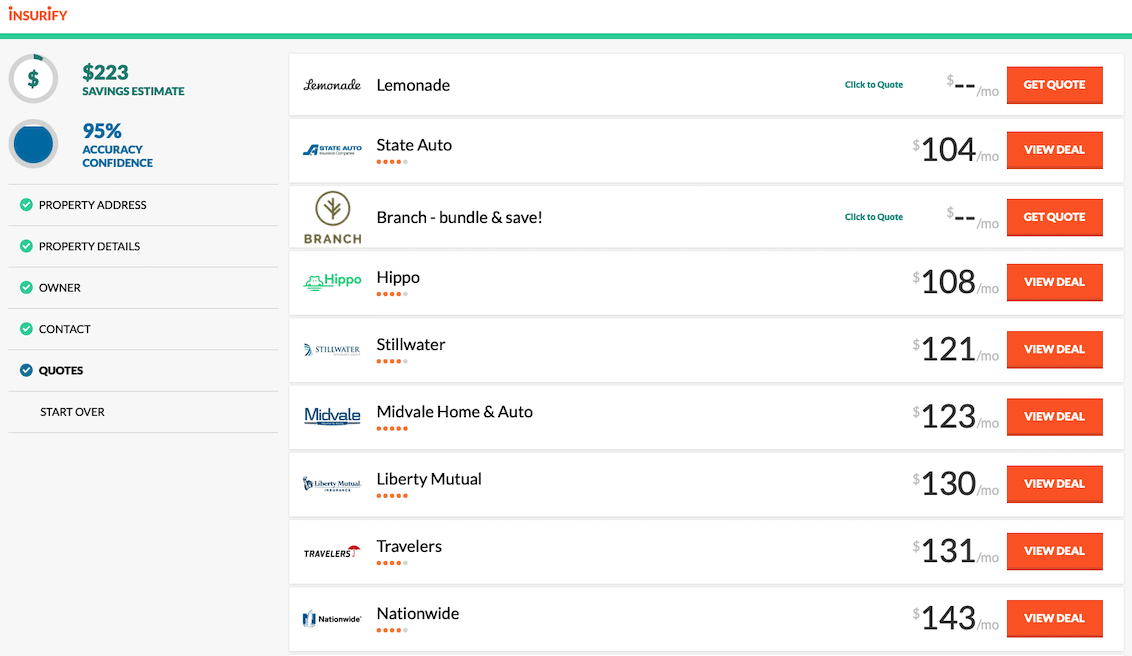

Houston auto insurance quotes vary depending on many factors, including the location of the driver, their driving history and the type of vehicle they own. We have compiled a comprehensive list of Houston auto insurance companies to help you obtain a quote that suits your needs.

Policygenius gives online auto quotes from Houston's top insurance companies including Liberty Mutual Allstate State Farm. Their website makes it easy to compare rates, customer service ratings and other important details. Even their tool can help you to find discounts or add-ons, which will lower your premium.

Allstate

Allstate offers auto insurance policies, including standard and commercial autos. They also offer motorcycle policies. Allstate offers discounts and benefits for good drivers. The company also offers accident forgiveness and features that allow them to avoid claims. They have a Spanish department and provide roadside service to Houston drivers.

Liberty Mutual

Liberty Mutual provides auto insurance and home insurance for Texans. Additionally, they provide policies for both students and military personnel. They offer resources on their website that can help you choose what kind of car insurance to buy. They also have an auto knowledge center online where you can receive advice about how to reduce the cost.

State Farm

State Farm provides auto insurance throughout Texas, and in other parts of America. State Farm offers many coverage options as well as a claims-free warranty. They also provide discounts to safe drivers, defensive-driving courses, and antitheft devices.

Progressive

Progressive Company, a well-known name in auto insurance for over 100 year's, offers a number of discounts to their customers. They offer a number of discounts to their customers, and they've recently launched a new app that lets you quickly and easily receive a quote on your phone.

Auto insurance houston tx

Houston residents will pay higher rates for their car insurance than other areas in the city. Houston has a very high population, and there is heavy traffic. Therefore, it is important to ensure that you have sufficient insurance.

Keep Your Record Clean

Your auto insurance rate will be more affordable if you have a clean driving history. You will see an increase in your auto insurance rates if you've had speeding citations issued, reckless driving charged, DUIs/DWIs, or at-fault accidents. These citations and incidents usually stay on your records for three to four years.

Gender

The gender of the driver will also impact their rates. Insurance for women is generally cheaper than that of men. Women also tend drive safer.

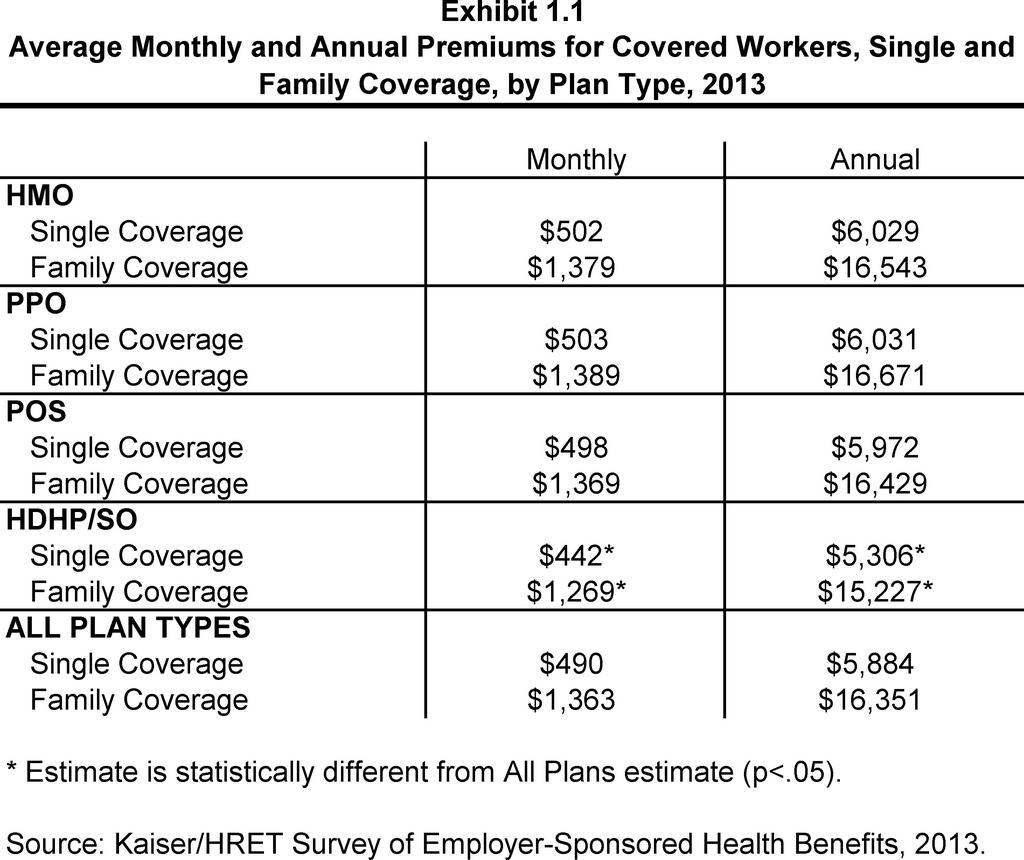

Bundling insurance policies with another provider can be an excellent option. It can result in discounts for multiple policies.