Connecticut mandates that drivers have minimum insurance coverage or they will be fined and their driver's licence could be suspended. It's not always easy to get the right amount of car insurance, but there are ways to reduce your premiums while still having enough coverage to cover any damages that may occur in an accident.

Best Car Insurance Companies CT

These companies also provide discounts for people who are good drivers, students, veterans or homeowners. These companies also typically offer high-quality customer service and flexible payment plans. To save money on CT car insurance, getting a quote is the easiest and most effective way.

Auto Insurance Quotes in CT

Connecticut's average auto insurance rates are lower than the national average. However, they may be higher if your vehicle is older or you live in an expensive area. Comparing quotes from multiple insurance providers will help you find the best price for your needs.

Minimum Car Insurance Required in CT

Connecticut requires drivers to carry liability insurance, which covers injuries and damage caused by your vehicle if you are found liable. The state also requires uninsured/underinsured motorist (UM/UIM) coverage to protect you in the event of a crash.

The maximum liability limit is the amount of money that your insurance will pay you for any injury you cause and any property damage. Minimum liability limits in the state are $50,000 for all injuries and $25,000 per person.

For additional protection against vehicle theft and damage, you should also look into a comprehensive or collision policy. These policies help pay for vehicle repairs and replacements in the event of an accident.

Car Insurance Discounts CT

These top Connecticut auto insurance companies provide a range of discounts in order to attract more customers. Discounts can be offered for a variety of reasons, including paying bills on time, driving safely, having a good driving record or buying a newer car.

Auto Insurance is more expensive for young drivers in CT

One of the most common reasons that car insurance rates go up is because a driver is younger and inexperienced. They are therefore more likely to make a claim compared to an experienced driver. This increases their insurance rates.

If you're under 25, you can lower the cost of your insurance by taking a defensive-driving course or enrolling in an accident prevention program. These programs will not only help you save money but can also improve your driving skills and increase the coverage of your insurance.

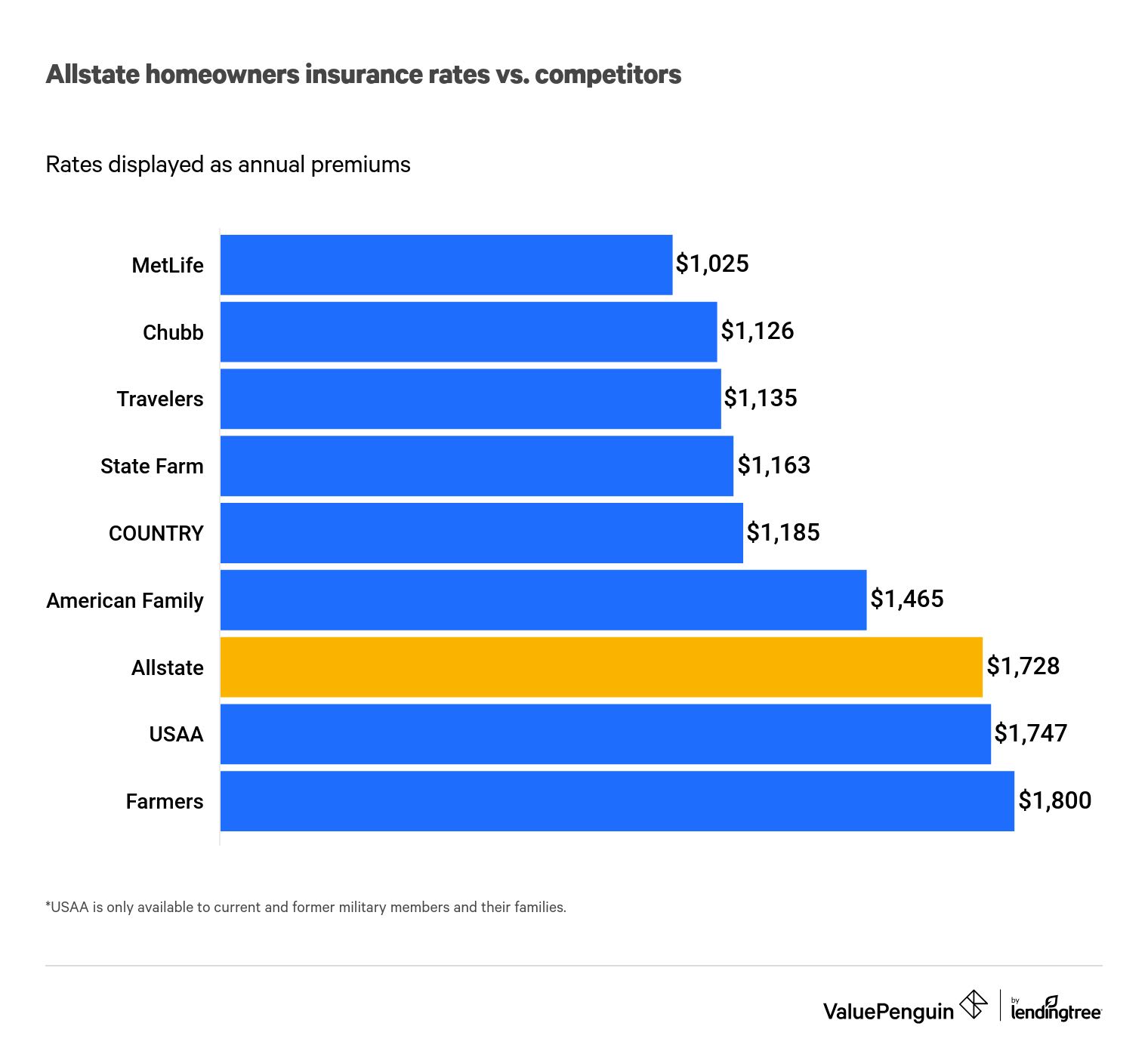

Connecticut has an average annual rate of $1,462. It is lower than the national average but can still vary a lot depending on factors like your driving history, credit score and other factors. Comparing quotes from different insurance companies will give you an estimate of the annual premium.